2025-2026 TUITION & PAYMENT

Tuition and fee information was shared via email with current families in December.

Tuition and fee information was shared via email with current families in December.

Tuition and fee information was shared via email with current families in December.

Tuition and fee information was shared via email with current families in December.

Tuition payments will be processed through the FACTS Tuition Management system, allowing each family access to their account at all times. All families are required to enroll in FACTS Tuition Management and a payment plan is the only way to secure your child’s enrollment at LCA for the upcoming school year.

Because we value our families, Legacy adopted continuous enrollment! This will save time because there are no forms to fill out year after year*! Once a student is enrolled, they are considered part of the Legacy family for the duration of their education. Because continuous enrollment is now the default, all families’ current payment plans will continue unless the Business Office is notified with any necessary changes or a family withdraws.

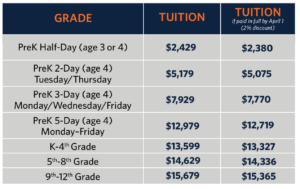

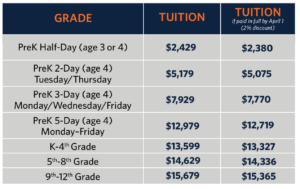

Enrollment for the next enrollment year will occur automatically, and families will be responsible for tuition according to the tuition chart above, unless written notification of cancellation/withdrawal is received by the school prior to the deadlines listed below.

In the unlikely event that a family wishes to withdraw/cancel their enrollment, they are required to complete an enrollment cancellation form and submit it to the Admissions Office. Current Legacy families may withdraw, free of charge, until January 31, 2025 after which time the following fees are in effect:

• Until January 31: No charge

• February 1–March 31: tuition for enrollment year will be charged at 10% of contract amount per student

• April 1–July 14: tuition for enrollment year will be charged at 20% of contract amount per student

• July 15 or later: tuition for enrollment year will be charged at 30% plus tuition prorated to the last day of the month of withdrawal (not to exceed 100% of the contract amount)

The tuition contract is in effect whether the withdrawal is for expulsion, dismissal, transfer, or otherwise. Under any withdrawal circumstances, the registration deposit is non-refundable and will not be prorated.

*It is your responsibility to update Legacy with any health, demographic, or pertinent information regarding your child. Please contact the School Office at 763.427.4595 with any changes.

Families applying for tuition assistance must complete an online application form and submit necessary supporting documentation to FACTS Grant & Aid Assessment.

Because tuition assistance is a scholarship and the funds are budgeted, the earlier you apply, the more funds are available. We have some very generous donors who help make some of these funds available, but there is a limited amount. The tuition assistance process requires completion of your federal taxes. Because our deadline is early, you may use the previous year’s taxes to apply. Please note, the Half-Day Preschool and all day, 2-Day PreK classes do not qualify for tuition assistance.

A multi-child discount will be applied to all families NOT accepting tuition assistance.

Not available if accepting tuition assistance.

Prorated discount for students enrolled in PreK 1/2-day, 2-day, and 3-day.

Under current legislation, parents may claim a credit and/or deduction on their Minnesota State Income Tax return for some K-12 education expenses. The amount of the credit/deduction depends upon family income.

The Legacy PreK program is a Minnesota licensed daycare provider. Tuition paid for PreK may qualify as a deduction on your federal and/or state tax return. Please contact a tax professional for further information.