Tuition & Payment

Tuition and Fees

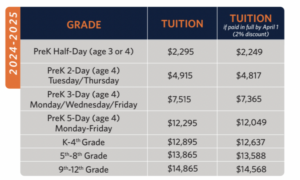

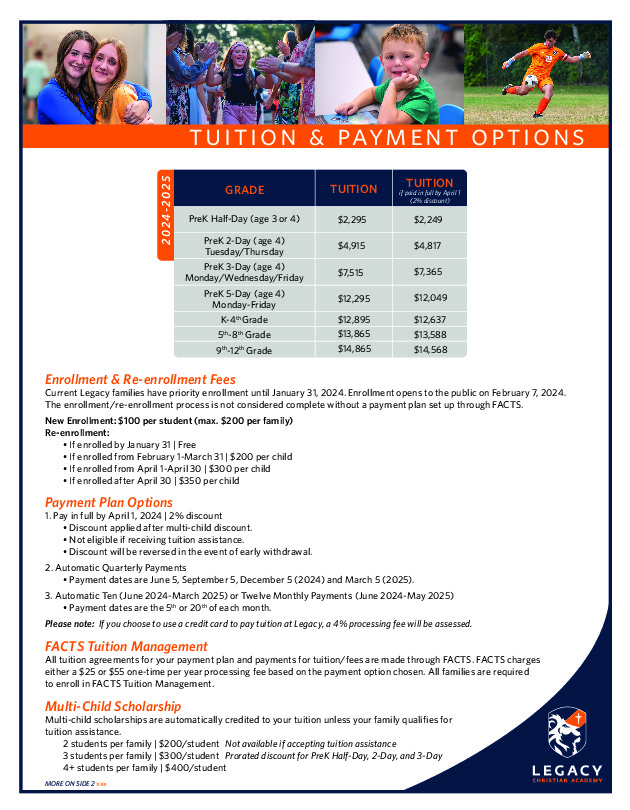

2024-2025 TUITION & FEES

Priority re-enrollment opened to current families on January 8, 2024. Enrollment for new families opened on February 5, 2024. Tuition and fee information was shared via email with current families in December.

Tuition and Payment Options and Information

FACTS Tuition Management

Tuition payments will be processed through the FACTS Tuition Management system, allowing each family access to their account at all times. All families are required to enroll in FACTS Tuition Management and a payment plan is the only way to secure your child’s enrollment at LCA for the upcoming school year.

Tuition Assistance

Families applying for tuition assistance must complete an online application form and submit necessary supporting documentation to FACTS Grant & Aid Assessment.

Because tuition assistance is a scholarship and the funds are budgeted, the earlier you apply, the more funds are available. We have some very generous donors who help make some of these funds available, but there is a limited amount. The tuition assistance process requires completion of your federal taxes. Because our deadline is early, you may use the previous year’s taxes to apply. Please note, the Half-Day Preschool and all day, 2-Day PreK classes do not qualify for tuition assistance.

- Current Families: Families applying for tuition assistance must complete the online application, pay a $40 tuition assistance application fee, and submit all necessary documentation to FACTS Grant and Aid Assessment via online.factsmgt.com/aid. Tuition assistance applications are due by February 15 and aid will be awarded in March. Due to budgeting and planning purposes, awards will be decreased by $250/child for any applications received after February 15. Late submissions will also result in delayed awards.

- New Families: New families applying for tuition assistance must complete an online application, pay a $40 tuition assistance application fee, and submit all necessary documentation to FACTS Grant and Aid Assessment via online.factsmgt.com/aid within 15 days of acceptance to LCA. Failure to do so may result in lower aid awarded.

Multi-Child Scholarship

A multi-child scholarship will be applied to all families NOT accepting tuition assistance.

- 2 students per family – $200/student

- 3 students per family – $300/student

- 4+ students per family – $400/student

Not available if accepting tuition assistance.

Prorated discount for students enrolled in PreK 1/2-day, 2-day, and 3-day.

Continuous Enrollment

Legacy is adopting continuous enrollment! The enrollment agreement you receive this January and need to complete will include provisions to adopt continuous enrollment for the following years. This means that after this year, your child(ren) will be automatically re-enrolled at Legacy each school year until their graduation from Legacy (unless they are withdrawn). This change will save families a great deal of time as they will not need to complete the entire enrollment process for each child every year.

Tax Credit and/or Deduction Opportunities

Under current legislation, parents may claim a credit and/or deduction on their Minnesota State Income Tax return for some K-12 education expenses. The amount of the credit/deduction depends upon family income.

The Legacy PreK program is a Minnesota licensed daycare provider. Tuition paid for PreK may qualify as a deduction on your federal and/or state tax return. Please contact a tax professional for further information.

The Legacy PreK program has also been approved to receive payments through the Anoka County Child Care Assistance program.